Ever since we were young, we’ve been taught to save money. Our parents bought piggy banks and instructed us to drop a penny now and then to save money. Back then, we still didn’t know the importance of saving. That was when we finally moved out from our parent’s houses and started living on our own. Now, we carry the burden of finding a stable job to be able to pay our bills and sometimes for our leisure. Budgeting for basic necessities, savings, and recreation proved to be more difficult the moment we hit adulthood.

If we’re not careful in handling our finances, we might end up having financial problems such as being in debt. If we let our impulse get the better of us, we’ll be living a stressful life figuring out how to pay debts without getting broke. Or worse, we might end up losing everything we worked so hard for because financial institutions might get them as a form of compensation to our debt.

How do we ensure that weren’t going to end up in this worst-case scenario? Here are our three budgeting tips to help you manage your money properly to become financially stable.

List All Your Expenses Before Getting Your Paycheck

List All Your Expenses Before Getting Your Paycheck

One of the most common mistakes we make is having a “go with the flow” attitude concerning budgeting. We understand that you might feel like you’re on top of the world the moment you get your paycheck. You tend to buy things you don’t need because of your impulse. Moreover, the gratifying feeling of having the freedom to buy all the things you want overwhelms you.

However, this will do you more harm than good in the long run. At the end of the day, you’ll be left wondering why your money suddenly disappears like a bubble. Before you realize it, you’ll be left struggling to sustain your days before your next paycheck arrives. How do we counter this?

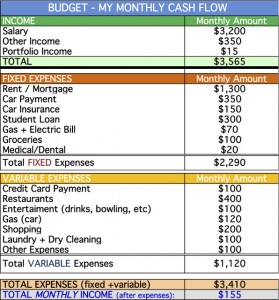

We can counter this by listing all your expenses first. In fact, we encourage you to list your budget before your paycheck comes. Prioritize your bills such as apartment rentals, electricity, water, food, etc. That way, you can pay them immediately. Once you’ve cleared out your necessities, spare some percentage for your savings. The ones left will cater for your expenses (e.g. transportation) and leisure. As such, you have a general idea where your money goes. It’s also important to stick to your budget in order not to get broke.

Do not be financially dependent on other people

Do not be financially dependent on other people

No matter how well we plan, there will always be a point in life where we’ll end up being in a financial constraint. At these times, we often seek our parents or friend’s help.

However, you shouldn’t make this a habit. Remember that the person you’re borrowing money from also worked hard to earn it. It would be disrespectful to them if you keep depending on them to patch up your things just because you’re not handling your finances well. You’re technically not part of their budget and responsibility.

If you find yourself unable to stop this habit of dependency, you need to find some way to break it. Either it’s time for you to spend less (go back to tip #1), or earn more to sustain your standard of living.

Remember that the person you’re borrowing money from also worked hard to earn it

Use money management tools

Use money management tools

If you want an external factor to help you in managing your finances, then it’s time for you to download a money management tool. There are several money budgeting apps you can download on Play Store that can help you in tracking your finances every month. These cash budgeting apps have cool features such as encoding your budget, tracking where your money goes, as well as paying your bills.

Yes, you can actually connect your bank account to these apps so that by the time you get your paycheck, you’re able to pay your bills before you get off track and spend your money for something you don’t need. You Need a Budget (YNAB) is our top pick when it comes to money budgeting apps.