GuilhermeMesquita/Shutterstock

GuilhermeMesquita/Shutterstock

The list is based on 1,120 responses, and ranked from least to most recommended. You can consider it a hedge fund reading list.

The books don't come cheap though. A used copy of the most recommended book retails for more than $900.

Here they are:

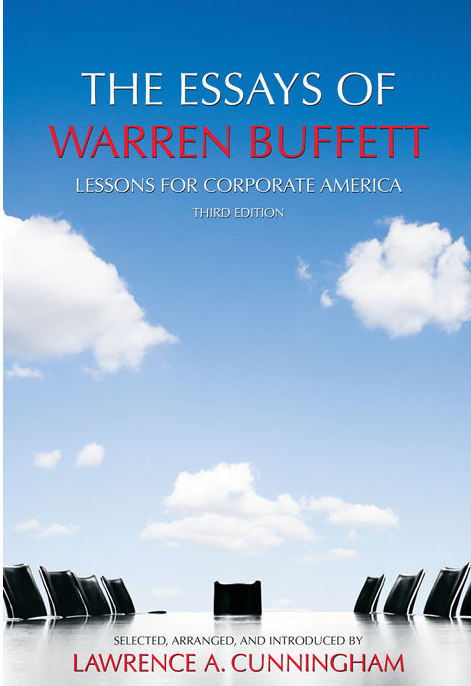

"The Essays of Warren Buffett" by Lawrence Cunningham

"As the book Buffett autographs most, its popularity and longevity attest to the widespread appetite for this unique compilation of Buffett's thoughts that is at once comprehensive, non-repetitive, and digestible. New and experienced readers alike will gain an invaluable informal education by perusing this classic arrangement of Warren's best writings."

Find it on Amazon »

"Poor Charlie's Almanack" by Charlie Munger

"'Poor Charlie's Almanack' contains the wit and wisdom of Charlie Munger: his talks, lectures and public commentary. And, it has been written and compiled with both Charlie Munger and Warren Buffett's encouragement and cooperation. So pull up your favorite reading chair and enjoy the unique humor, wit and insight that Charlie Munger brings to the world of business, investing and life itself. With Charlie himself as your guide, you are about to embark on an extraordinary journey toward better investment, decision making, and thinking about the world and life in general. Charlie's unique worldview, what he calls a 'multidisciplinary' approach, is a self-developed model for clear and simple thinking while being far from simplistic itself."

Find it on Amazon »

"One up on Wall Street" by Peter Lynch

"America’s most successful money manager tells how average investors can beat the pros by using what they know. According to Lynch, investment opportunities are everywhere. From the supermarket to the workplace, we encounter products and services all day long. By paying attention to the best ones, we can find companies in which to invest before the professional analysts discover them. When investors get in early, they can find the 'tenbaggers,' the stocks that appreciate tenfold from the initial investment. A few tenbaggers will turn an average stock portfolio into a star performer."

Find it on Amazon »

"Reminiscences of a Stock Operator" by Edwin Lefevre

"Reminiscences is a fictionalized account of the life of the securities trader Jesse Livermore. Despite the book's age, it continues to offer insights into the art of trading and speculation. In Jack Schwagers Market Wizards, Reminiscences was quoted as a major source of stock trading learning material for experienced and new traders by many of the traders who Schwager interviewed. The book tells the story of Livermore's progression from day trading in the then so-called 'New England bucket shops,' to market speculator, market maker, and market manipulator, and finally to Wall Street where he made and lost his fortune several times over. Along the way, Livermore learns many lessons, which he happily shares with the reader."

Find it on Amazon »

"Common Stocks and Uncommon Profits" by Philip Fisher

"Widely respected and admired, Philip Fisher is among the most influential investors of all time. His investment philosophies ... are not only studied and applied by today's financiers and investors, but are also regarded by many as gospel. This book is invaluable reading and has been since it was first published in 1958."

Find it on Amazon »

"Security Analysis" by Benjamin Graham and David L. Dodd

"This new sixth edition, based on the classic 1940 version, is enhanced with 200 additional pages of commentary from some of today’s leading Wall Street money managers. These masters of value investing explain why the principles and techniques of Graham and Dodd are still highly relevant even in today’s vastly different markets. The contributor list includes:

Seth A. Klarman, president of The Baupost Group, L.L.C. and author of Margin of SafetyJames Grant, founder of Grant's Interest Rate Observer, general partner of Nippon PartnersJeffrey M. Laderman, twenty-five year veteran of BusinessWeekRoger Lowenstein, author of Buffett: The Making of an American Capitalist and When America Aged and Outside Director, Sequoia FundHoward S. Marks, CFA, Chairman and Co-Founder, Oaktree Capital Management L.P."Find it on Amazon »

"The most important thing illuminated" by Howard Marks

"Whether you’ve already read The Most Important Thing cover to cover or are new to the book, The Most Important Thing Illuminated will give you an unprecedented look into how America’s top investors make decisions and achieve financial success."

Find it on Amazon »

"You can be a stock market genius" by Joel Greenblatt

"You’re about to discover investment opportunities that portfolio managers, business-school professors, and top investment experts regularly miss—uncharted areas where the individual investor has a huge advantage over the Wall Street wizards. Here is your personal treasure map to special situations in which big profits are possible, including:

Spin-offsRestructuringsMerger SecuritiesRights OfferingsRecapitalizationsBankruptciesRisk Arbitrage"Find it on Amazon »

"The intelligent investor" by Benjamin Graham

"The greatest investment advisor of the twentieth century, Benjamin Graham, taught and inspired people worldwide. Graham's philosophy of "value investing" -- which shields investors from substantial error and teaches them to develop long-term strategies -- has made The Intelligent Investor the stock market bible ever since its original publication in 1949."

Find it on Amazon »

"Margin of Safety" by Seth Klarman

"Taking its title from Benjamin Graham's often-repeated admonition to invest always with a margin of safety, Klarman's 'Margin of Safety' explains the philosophy of value investing, and perhaps more importantly, the logic behind it, demonstrating why it succeeds while other approaches fail. The blueprint that Klarman offers, if carefully followed, offers the investor the strong possibility of investment success with limited risk.

'Margin of Safety' shows you not just how to invest but how to think deeply about investing - to understand the rationale behind the rules to appreciate why they work when they work, and why they don't when they don't."

Find it on Amazon »

DON'T MISS: